Monterey Car Week, along with the auctions that surround it, is too big to be called a ‘car event’. It’s really a takeover of the entire Monterey Peninsula in California, and beyond, by those who love driving. And, this being America, the money follows closely behind.

This year, there were five major live auctions, offering a total of 1143 vehicles for sale – a little down on last year’s total of 1229. At the time of writing, the average sale price of $476,965 was almost the same as in 2023, and the sale rate went up a little from 69 percent to 72 percent. That’s not far off what we’d expect from a classic auction anywhere in the world right now.

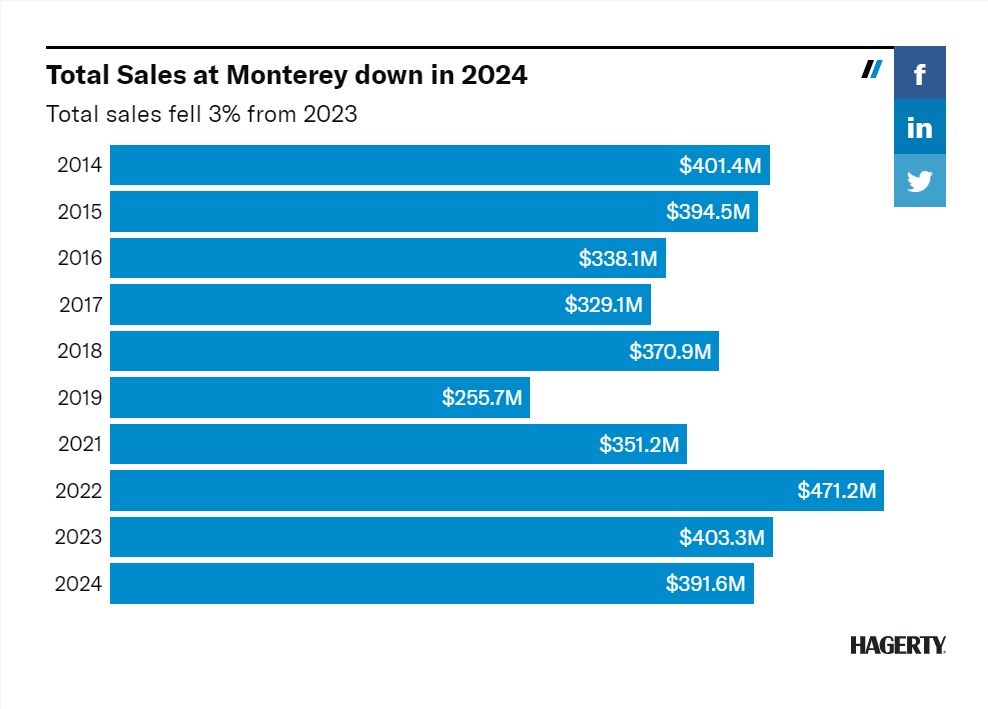

But the big figure, the total of all sales*, dropped below expectations. $391.6million-worth of cars may seem like a lot, but in Monterey terms, it’s not a strong year – way below Hagerty’s forecast of $430m to $488m, and a long way shy of the post-Covid 2022 record, when $471.2m-worth of vehicles were sold at auction during the week.

Although other auction events such as Scottsdale and Paris often attract big numbers of cars to the block, Monterey is where the really serious machinery emerges into the sunshine. This year, however, those cars valued at $1m-plus seemed to struggle unless they were exceptional.

That was especially true of older classics, cars considered the more traditional collector models. This year, only 52 percent of $1m-plus cars built before 1981 sold, with Ferraris – usually a dominant marque at Monterey – hit even harder, with pre-1974 $1m-plus models down to 51 percent sell-through compared with an average of 84 percent over the past three years at the same sales. More modern cars performed better: post-1981 cars valued at over $1m sold at a rate of 63 percent, and 73 percent of supercars worth over $500,000 and less than four years old sold.

So, why the change? In one respect, what happened at Monterey is a reflection of a wider trend: Hagerty has tracked price corrections affecting numerous elements of the market over the past year – around 40 percent of cars listed in the UK Hagerty Price Guide have dropped in the past 12 months.

Buyer-demographic data, as I’ve written about many times in the past, are also a key factor, with buyers focusing on more modern marques.

But we also live in uncertain times: some of those who attended the Monterey event reported an unease, and an element of political discussion that has been less evident in the past. The US is in election year, and that means uncertainty; the tax rules and other legislation that will dominate the next four years isn’t yet written. Plus, two major regional conflicts that threaten to escalate could make a big impact on the global stock markets. Given that situation, it’s no wonder that some of the buyers of more expensive cars sat this one out.

*Correct at the time of writing; may vary with post-sale deals.