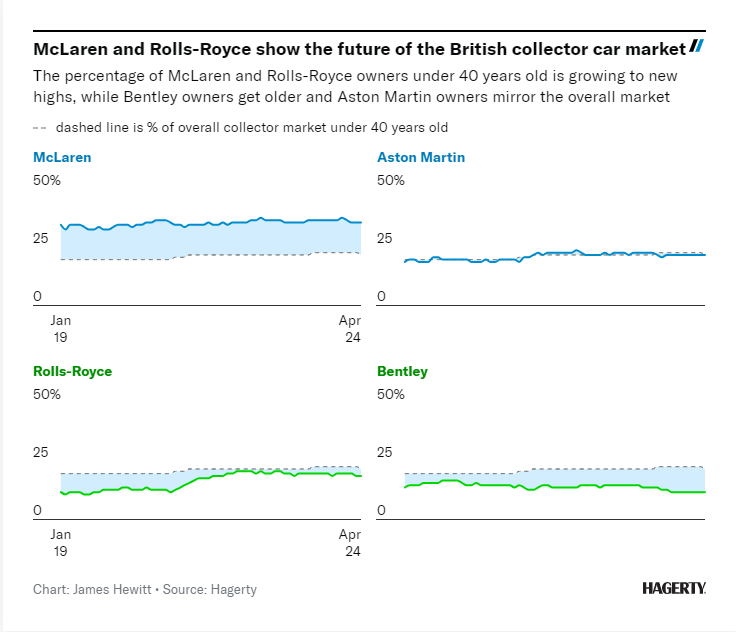

At first glance, you may not think Rolls-Royce and McLaren have much in common. One has been building silent, supple and bespoke luxury cars since 1906. The other is half as old and makes loud, brash supercars.

Their differences are innumerable, but both are thriving English car makers – and, perhaps surprisingly, each speaks to relatively young enthusiasts, as measured by Hagerty’s insurance-quote data. This shows that the percentage of people under the age of 40 buying a Rolls-Royce or a McLaren is growing faster than for other British brands.

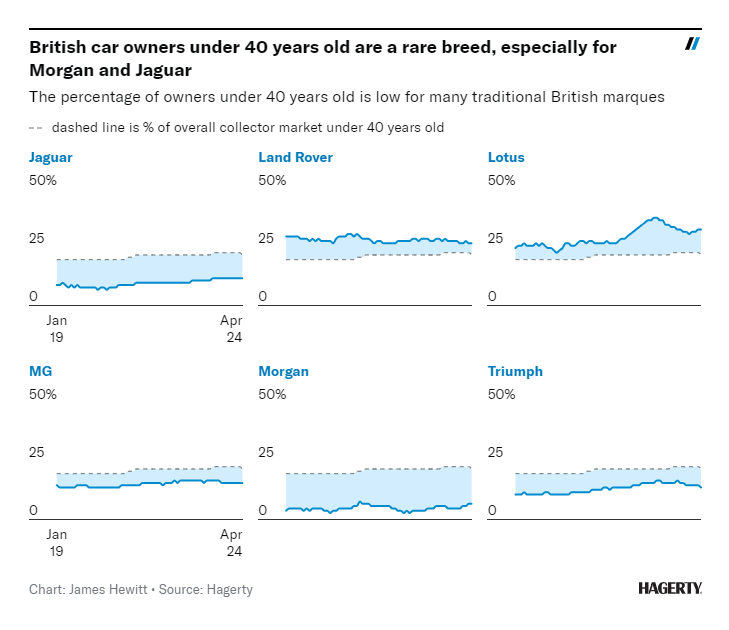

In general, enthusiasm for Britain’s best skews toward older buyers. For example, 65.5 per cent of purchaser interest for Triumph TR3s comes from baby-boomers or older, and for 1961-67 Jaguar E-types the number is 66 per cent. Yet this segment of the car-enthusiast population makes up barely one third of the market overall. For Morgans, it’s even more dramatic, with just seven per cent of buyer interest coming from enthusiasts aged 40 or younger.

There are some youthful exceptions, however. About 32 per cent of buyer interest for Lotus comes from enthusiasts 40 or younger, and for Land Rover it’s 27 per cent, compared to only 18 per cent for Porsche and 17 per cent for Ferrari. The share for both Lotus and Land Rover, though, has been steady. For Rolls-Royce and McLaren, that share has grown conspicuously. For the latter, such growth makes sense. Over the past decade or so, McLaren has been churning out more and more competitively priced supercars – exactly the kind of thing that appeals to younger buyers.

Rolls-Royce, on the other hand, may build the “Best Car in the World” (its words), but it does so for a far more discerning motorist. And while we tend to think of Bentley as having a more youthful reputation, just 12 per cent of buyer interest comes from enthusiasts 40 or younger.

Meanwhile, according to Hagerty data, younger buyers turning to Rolls-Royces are gravitating toward Silver Clouds from the 1950s and ’60s and to Silver Shadows from the 1960s and ’70s. This is surprising considering the age of those models, but it also makes sense given that Silver Clouds and Silver Shadows are among the cheapest ways to park the Spirit of Ecstasy in your garage.

This youthful shift toward Rolls-Royce in the classic-car market mirrors a similar shift for the company in the new-car market. After a year of record sales in 2023, former Rolls-Royce CEO Torsten Müller-Ötvös credited youthful clientele: “We are now an average age of 42; we are even younger than a brand like Mini, for instance.”

Although Rolls-Royce and McLaren may operate at different ends of the automotive spectrum, these two British badges look like they’ll be relevant in the collector car market for years to come.

Read more at Hagerty.