Making sense of the collector car market is a very difficult task at the moment. On the UK side of the Atlantic, it seems to have been cooling off since 2023, with rampant inflation, increased supply of new cars and the cost-of-living crisis often cited as the reasons why the boom days of the post-pandemic era are now in the rear-view mirror.

Meanwhile, US sales have continued to post record-breaking results. Last November, Sotheby’s sold a Ferrari 330 LM/250 GTO for a remarkable $51.7m, making this the second-most expensive car ever sold at auction. Other notable results came from The White Collection of Porsches, which brought in more than $30m, as well as the record-breaking $19m sale of Lewis Hamilton’s Mercedes-Benz W04 Formula 1 car.

US momentum then continued into this year, with Barrett-Jackson’s flagship Florida sale achieving a record $207.6m in total sales. This was followed by Gooding & Co.’s Amelia Island auction, where a Mercedes-Simplex 60HP sold for over $12m, making it the most expensive pre-1930s model ever auctioned.

Some of the most extraordinary cars in the world have been sold in the past year, and I think the market is continuing to develop very healthily

To try to make sense of it all, we sat down with automotive historian and appraiser, and Audrain CEO, Donald Osborne at the 2024 Goodwood Members’ Meeting.

“Some of the most extraordinary cars in the world have been sold in the past year, and I think the market is continuing to develop very healthily – which is the way the art market has behaved for decades,” Donald says thoughtfully. “That is, you can see a real bifurcation between the cars that are the ‘best of the best’, and those that are just ‘okay’.”

We’re sitting with Donald in the Jackie Stewart Pavilion, which overlooks the Goodwood Motor Circuit pitlane. As an unapologetic enthusiast, Donald occasionally pauses to appreciate the sound of whatever rare historic race car is flashing towards Madgwick on the circuit below.

“Provenance is absolutely everything,” he continues. “Condition is important, but not the ultimate determining factor, because people are really leaning into the whole idea of experiential ownership – they are buying cars they can use, whether it be for concours, rallies or racing. They’re not buying cars just to look at.”

Donald’s assessment perhaps alludes to how, when interest rates were low and loans were cheap, buyers who weren’t necessarily enthusiasts were speculatively purchasing classics to make money. Now this is no longer the case, it makes less sense to buy a car purely as an investment.

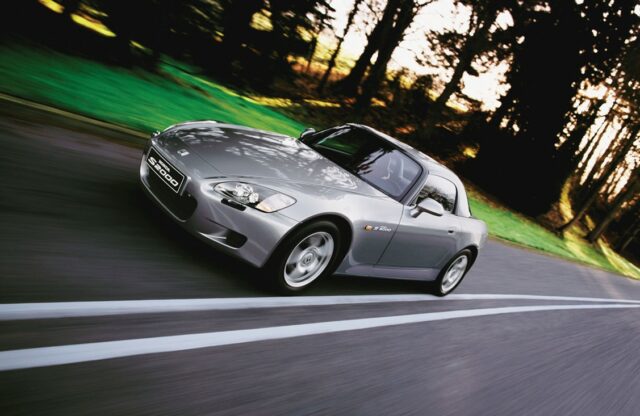

“A number of collectors I know are slowly moving away from the cars that they look at or don’t drive,” Donald explains. “They’re looking for cars they can drive, and which are fun to drive. You see a wider disparity than ever between the prices of cars that people want to use and are important, and those of other cars. Thankfully, I can see this adoration of the zero-kilometre car coming to an end. To me, it makes absolutely no sense, particularly as cars get more sophisticated with hybrid systems and so on.

“I think that’s really healthy because, if you look at the auction market, sell-through rates are still really good, and the prices are reflective of what interest particular models have in the market. So, when people say: ‘This car is not selling for much money,’ the important thing is that someone is still buying it, so I don’t think there are a lot of sellers with unrealistic expectations right now. People have realised that just because they have seen a similar model to what they’re selling achieve a record price, it doesn’t necessarily mean their car will go for the same amount.”

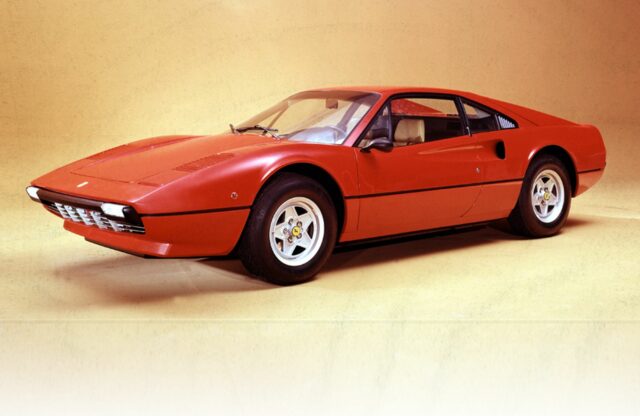

Donald’s assertion that buyers are now favouring more usable classics could perhaps explain why there is still strong demand for Youngtimer models of the 1980s and 1990s, while the market for older vehicles – particularly from more obscure marques such as Allard, Frazer Nash and Bristol – has contracted in recent times.

Another often-cited reason for this, is the ‘generational shift’ phenomenon, which posits that the demand for newer classics increases as older buyers leave the market. The present market seems to be undergoing such a change, as Baby Boomers are currently being replaced by Generation X’ers and Millennials.

“There are a lot of new people coming in, which is very interesting because I’ve said for a long time that I don’t believe in generational shift,” Donald says. “On the contrary, there are young people who are interested in cars from the 2000s and ’90s and Veteran cars – it’s whatever captures their imagination and interest, and what they have the chance to be exposed to.

“The Porsche 944 is an example I use all the time. When the 944 was new I ordered one, but I ended up cancelling my order because I bought a Volkswagen Scirocco instead. I thought: ‘Why buy a Porsche with nothing on it, when I can buy a Scirocco with every option for $500 less? But it’s interesting, because the 944 is a car that a lot of people in their early 20s have fallen in love with, because it’s a Porsche they can afford to buy, they can work on it and it provides a great driving experience. So, you’ve got a car that 60-year-olds and 20-year-olds both love for all the right reasons.”

So, if generational shift isn’t why certain cars are falling out of favour, what else could be to blame? “Adolfo Orsi in his wonderful book the Classic Car Auction Yearbook, does a fantastic analysis of data that shows the average age of cars sold at auction around the world by major auction houses. There are many more newer models consigned now than used to be the case, but if you look at the sell-through rates of cars from the 1930s and Veteran era, they’re much higher than for newer cars.

“That’s because these are better examples that draw more interest and, therefore, more buyers. So, a car from the 1930s that is easy to drive, modern-traffic friendly and comfortable, is preferred over something that is not – and it’s the same story with Veteran cars. It’s the basic rule of collectability: as the decades get further and further away, the cream rises to the top.”

Exposing younger enthusiasts to a wider variety of cars is very important to Donald, and is reflected in Audrain’s very own Youngtimer show, which is an event aimed at enthusiasts under the age of 30. Inclusion is the name of the game, and from there it’s hoped that passions and interests of the next generations will grow as they are exposed to cars they wouldn’t normally see.

“Also, in the main field of the Audrain Concours this year, the newest cars will be from 1978,” Donald enthuses. “In the 30Under30 classes we take cars up to 1992, so the idea is that – as with the Youngtimers tagline – collecting is moving forward. It’s like the ever-expending universe, because the 20-year-old cars of today are from 2004, and in another ten years it will be 2014.”

The conversation then shifts towards Donald’s personal collection, and whether any of the temptations offered in Bonhams’ auction at the Members’ Meeting tent have caught his eye.

“Again, most of the models there are cars that people would buy and use. These are the most important cars that you could possibly find for sale, because no one is going to buy a $10m one-of-one car – because you’re not going to use it and you probably can’t afford it. It’s about finding something that provides a great deal of fun and pleasure.

“But of everything in the tent, there’s a 1905 De Dion Bouton that I find absolutely adorable,” he smiles. “Over the past 20 years, I’ve just fallen in love with Veteran cars, because they come from a time of imaginative inventors that were confronted with a problem they had to solve. So, there’s this wonderful variety of solutions.

“The Bristol recreation is also absolutely amazing, it’s just the wackiest thing ever. But no, I’m not trying to buy anything; I bought two cars accidentally in December and January,” Donald laughs. “The first car was a Lancia Appia Sedan, which I ended up buying while visiting a friend’s shop in Italy. Then, I was at the Bonhams sale in Scottsdale, and saw a 1969 Fiat Moretti 500 Sport. It was identical in appearance to a Simca 1000 Bertone Coupé – both designed by Michelotti. I was minding my own business, sitting in the front row of the auction. I put my hand up, not expecting to win it, and I did.”

Despite knowing what cars are most likely to make a return on investment, Donald’s most recent acquisitions prove the best models you can buy are often those that are fun to drive and provide an emotional connection. Perhaps the current direction of the market simply means cynical buyers are moving out and enthusiasts are sticking around. Long may it continue.

Read more on Audrain here.