WORDS: JOHN MAYHEAD | PHOTOS: RM SOTHEBY’S

Look at the headlines from 2023, and you’d think that the US collector car market is still booming. The Ferrari 330 LM/250 GTO sold by Sotheby’s in November became the second-most valuable car ever sold publicly at auction when the hammer fell, achieving $51.7m with costs. The White Collection of 56 Porsches set more records when it was auctioned earlier this month, including a 2019 911 GT2 RS Weissach and a 2016 911 R – both of which sold for over $1m, and a 2015 918 Weissach Spyder for $3,937,500. All were well over the top Hagerty value for their models. Then, Lewis Hamilton’s first Mercedes Formula 1 championship-winning car, the 2013 Mercedes-AMG Petronas F1 W04, sold for just under $19m, unseating a run of Schumacher cars to set a new modern F1 record.

But look deeper into the data, and some of those records are maybe not as dominant as the news stories may have you believe. The 330 LM/250 GTO is undoubtedly very special – a Scuderia Ferrari car with excellent period racing history, but built as a 330 LM and only later converted (by Ferrari) to 250 GTO spec. As a result, Hagerty’s analysis was that the sale price accorded with a very valuable 330 LM rather than a pure 250 GTO; many expected it to sell for more. Then there’s the White Collection: those cars sold very well, but were the absolute pinnacle of Porsche collectors’ wishlists, including paint-to-sample colours, delivery mileage, museum-quality condition and a huge array of options. According to Hagerty’s chief analyst John Wiley, those options alone accounted for 78 percent of the value increase over the top Hagerty price. And the Vegas sale of Lewis’s car? Now, that one was interesting, but I’ll save that for another time.

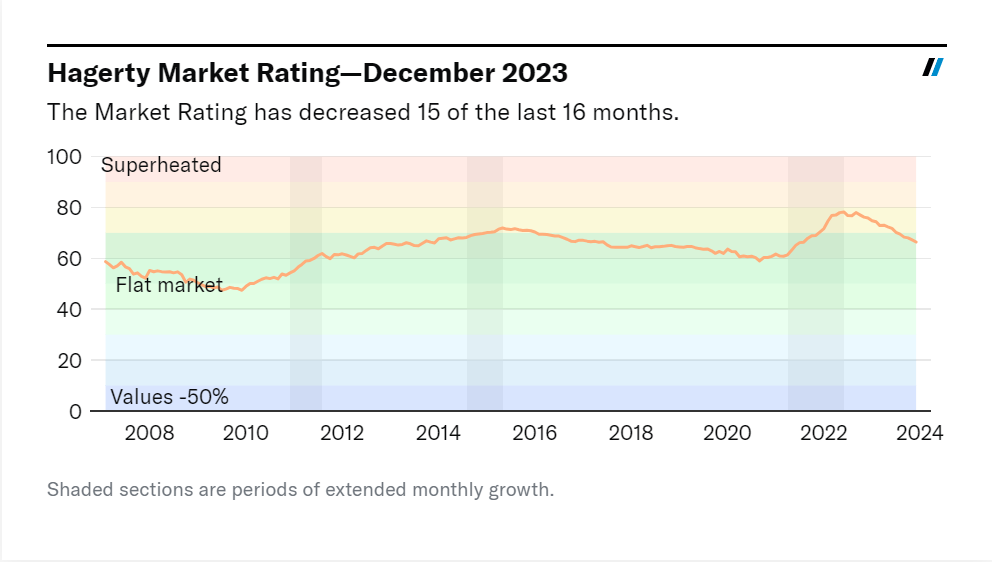

Other than the sales that caught the public’s attention, the rest of the market changed a great deal from 2022. Hagerty’s Market Rating – a monthly analysis of the trajectory of the market – just fell to a level 11 points lower than its 2021 peak, dropping 15 of the past 16 months. Two major factors led to this drop: Hagerty’s Broad Market Insured Values – the 12-month moving ratio of sub-$200,000 cars that increased their insured value compared to those that reduced – just experienced its third largest single-month drop since this metric was added to the Market Rating in 2010. The Auction Median Sale Price metric saw its third largest single-month decrease since the start of the pandemic, and is now at its second lowest value of all time.

Looking in detail at auctions, the markers have been there for a while. The auctions surrounding Monterey Car Week back in August – often seen as a great barometer for the US car market – were impressive, but the sell-through rate dropped in every price category and was down ten points to 68 percent overall. Compared with the Hagerty Price Guide condition-appropriate price, the median premium of a sale was 9.8 percent, down from 18.3 percent in 2022. That drop in auction sell-through rates has been reflected across the industry throughout the year.

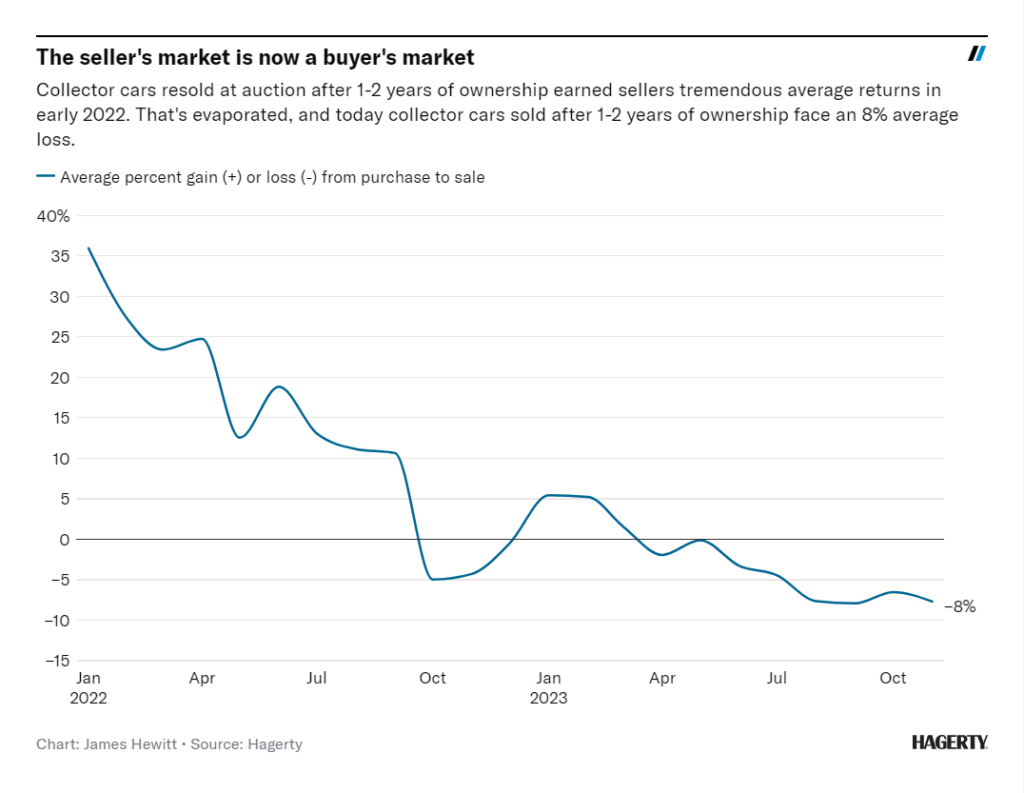

One of the most convincing market indicators is by comparing cars that return to auction within a relatively short period of time. Although this isn’t infallible – value may have been added through restoration or provenance research – on average, it is a good indicator of which direction the market is moving. A full 68 percent of cars – 51 out of 75 – bought at public auction in 2022 and then sold in November 2023 had negative returns. The average return for this group is -6 percent, while the median is -10 percent. That’s a precipitous drop from the beginning of 2022, when the average return for vehicles held for 24 months or less was an increase of 36 percent.

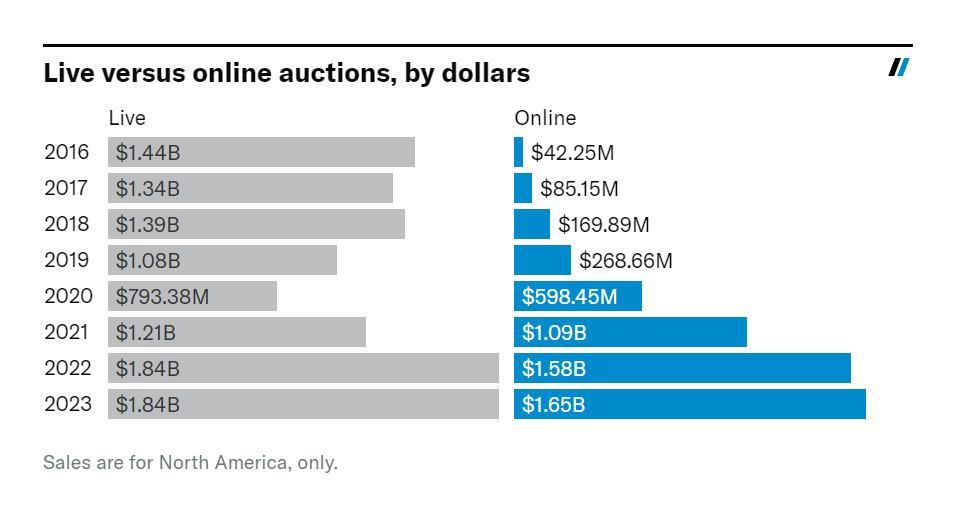

So, what does all this mean? The post-pandemic boom may be over, but a different landscape is emerging. More sellers are in the position that they have to sell – no-reserve auction lots are at their lowest level since 2019 – which means there are deals to be done for those who have the means and motivation to buy. Plus, we’ve changed the way we purchase – estimated year-end figures suggest online-auction total sales were only just bettered by their live-auction rivals. The pressure for all of those in the trade to consign the very best cars has never been higher, and never harder to achieve. I believe 2024 may be a year of consolidation – of collections as well as businesses – but also one of potential, as correcting prices allow some buyers back into play.